Gm Brazeryens. February, WTF! Anyone else still catching up from the holidays? 🥹

[Welcome to Issue Number 23 of The House Brazeryen, where we break down the latest #STEM, #biotech, and #SciComm-related news for you fortnightly, in roughly 5 minutes. Brought to you by Brazen Bio, Brazen Capital, and brainsurgerydropout.]

Was this forwarded to you? Mash this subscribe button, homie.

RE: BUILDING A THERAPEUTICS STARTUP ✨WITHOUT✨ VC

by Shawn Carbonell, MD, PhD — A recent post I threw into LinkedIn and Twitter like a live grenade really struck a nerve and led to a lot of energetic discussion in the comments and DMs (thanks Neil Thanedar for the initial inspo):

BRAZEN BREAKDOWN

The point isn’t that trickle feeding your startup with six-figure angel checks is a good thing; it is SUPER stressful and led to the deterioration of my mental health to the point of complete burnout and the dissolution of my marriage. Suboptimal.

The point is that it CAN be done through sheer brute strength when there are no other options (as in my case, 100% NOs from hundreds of VCs pitched over several years). Here are some further nuances:

Biotech startups, particularly in biologic therapeutics, require a lot of money because the manufacturing process alone for phase I scale drug product is $5-10M. However, you don’t pay this all upfront. You pay according to approximately 20-30 smaller milestones over 2-3 YEARS. This is how we were able to eeek through the process. Nailing milestone after milestone in parallel with the broader company milestones. We also combined this with tax incentives.

Tax incentives? Yes! We took advantage of favorable tax incentives in other countries such as CIR in France and SRED in Canada. The latter program saved us nearly $500K (50%) on our tox and the former saved us MILLIONS on CMC.

Small, virtual teams. Even a decade ago, the best way to do a biotech startup was remote plus CROs. My startup never had more than seven people on the payroll at the peak and when we submitted our first IND to FDA we only had an internal team of four. Here, consultants are your friend (of course 80% of them are shit so kiss a lot of frogs).

Equity crowdfunding has emerged as a viable way to raise up to $5M a pop. The companies that do the best have already cultivated an engaged online community. If you are not already on social media you are less likely to nail it.

So—NO—you don’t need a $10M seed or a $50M A round to build your startup. Conversely, finding billionaires and their buddies is really not scalable either (it was literally luck and proximity in my case) which is why we need more innovative funding mechanisms beyond Pre-Seed, Seed, Series XYZ.

It’s also why Brazen Capital now exists. Our first fund is focusing on being the first check in to your nascent startup and, if all goes well, subsequent funds will help folks further along to nail their milestones. In coming issues and on the socials I'll dive deeper into everything.

PS: While we have deployed capital (third investment announcement soon!), we are still raising the fund. If you are an accredited investor and want to help the mission TALK TO US!

BRAZEN CAPITAL: VENTURE FELLOWS

As Brazen Capital is a super scrappy small team and frankly we like our own product, we have decided to continue to work with our first two JVFs, Katie Pohl and Liam Lewis, AND bring on a third Venture Fellow, Alexandra Lanjewar, PhD!

Therefore, we are temporarily pausing our formal Junior Venture Fellows (JVF) program that we started last Fall. Thank you to everyone who applied for the second batch. Humbled by the response. We do have plans to bring it back.

BRAZEN BREAKDOWN

If you have a pre-pre-seed bio startup and are looking for your first check shoot us a message and you may just get to meet them all!

VC CORNER: THE BURDEN IS OURS

Contributed by Scott Alpizar, PhD — Last issue we took a closer look at how to build a diverse startup. Having a diverse team or being a diverse founder undoubtedly makes your startup better. Unfortunately, there’s a critical area where this is a disadvantage—raising money.

The statistics are… not good. A Diversity VC report from November showed that VC backed startups were ~90% men and ~72% white and that only 1.87% of VC money was allocated to women and minority-owned startups. Separately, a Crunchbase article from last summer highlighted that Black-founded startups were being disproportionately impacted by the current macroeconomic conditions—something I don’t anticipate has gotten much better since.

At first, I wanted to write about how you can overcome this, but then I realized—the burden shouldn’t be on you. It’s on us to do better. How? Let’s break it down!

BRAZEN BREAKDOWN

Identify and Eliminate Implicit Biases. VCs need to recognize that they likely have biases. Once we understand that, we can start overcoming them. A great way of doing this is to seek out formal mentoring or coaching.

Revisit Funding Criteria. Are the ways that VCs judge startups excluding underrepresented founders? Well, look at who has been passed on. Make decisions based on the accomplishments and potential of the company, not the founder’s gender or skin color.

Work Harder for Deal Flow (Outside of Warm Intros). I recently came across an article proposing to ban warm intros, a damaging practice that excludes those lacking networks. VC efforts should turn to growing networks in new places—great founders can be anywhere!

Continue Dedicating Funds to Underrepresented Groups. While the size of VC funds for underrepresented individuals was smaller, even a small investment can go a long way for a founder unable to raise an initial friends and family round like their more connected counterparts.

In the end, we need systemic change. It won’t happen overnight, so you may still face the usual challenges. The best advice that I can give is to find the people who truly believe in you. Look to VC funds specifically supporting underrepresented founders. Some that come to mind: Backstage Capital (I’ve followed Arlan Hamilton’s journey for years and she’s doing incredible things), Overlooked Ventures, and of course Brazen Capital—but there are many others too.

If you’re underrepresented and want any advice on how to spin a company out of academia, what VCs are looking for, or anything else commercialization/startup related, feel free to reach out! I’m happy to help.

📈 BRAZEN ALPHA

❤️🩹 Heal.LA: BioScience and Healthcare Accelerator (Los Angeles only)

🧠 One Mind Accelerator for mental health startups (DUE TODAY!!!)

🛫 Cornell’s Runway Startup Postdoc Program (DUE 2/15)

If you know of an incubator/accelerator or other program/event that helps founders in the space feel free to reach out and we may include it in the next issue.

😋 BRAZEN SNAX

💩 Finch finds out “people don’t want to eat other people’s shit” the hard way

🔥 “Heating”: TikTok can make anyone go viral with the push of a button

💉 The future is localized cancer immunotherapy: CAR-T edition

🐰 Animal models are wrong more often than they are right? FDA: Yes

🚀 Is a post-incubator, incubator what biotech needs?

💔 Love hormone my ass: oxytocin not necessary for pair bonding in voles

☄️ University ranking rancor. Top schools boycott ranking surveys.

🍭 Turns out “nonessential amino acids” are essential in diabetic neuropathy

⏰ TikTokCrak: What it’s like to be a med student rotating in surgery

🔪 CARVEOUT

Great banter between Cat Li and Divya Bhat on the critical subject of startup cofounders on the Y Combinator podcast!

🙏🏽 A DOSE OF GRATITUDE

Grateful for Claude Silver, Chief Heart Officer of VaynerX for her inspiring talk about building “people-first” organizations last week (Day One Bootcamp).

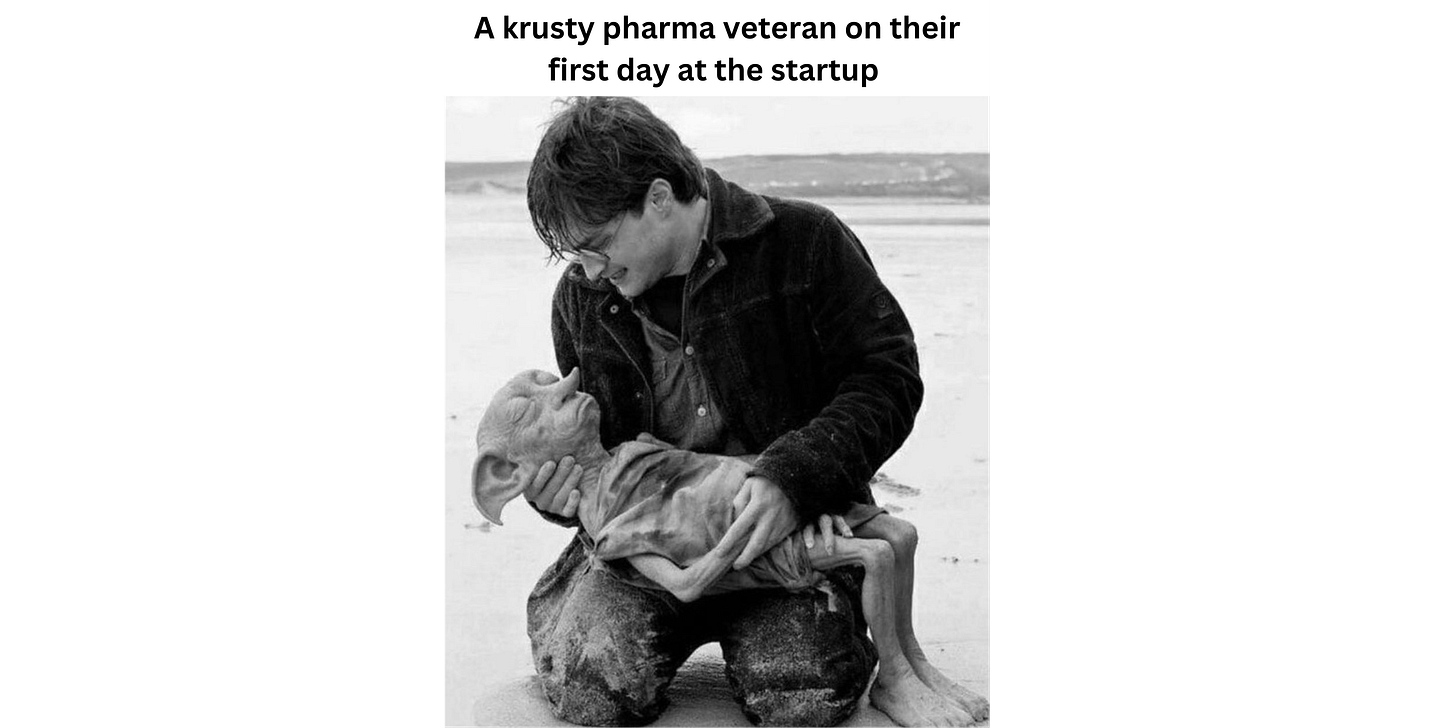

🙃 BRAZEN MEME

✍️ FEEDBACK

Feel free to tweet all thoughts, questions, and insults to us @brazenbio. Bring it. No, really. COME👏🏽AT👏🏽US👏🏽BRO👏🏽